Low Interest Student Loan

Whether you're looking for your first student loan, or your trying to figure out how to pay off the ones you have this article will have all the information you need to make the process easier.

Student loans and how they work can be confusing for most people. At the same time, it is very important for you to understand how student loans work in order to get the best deal and avoid common but costly mistakes.

After reading this article you will have a basic understanding about student loans. We will also talk about your options to paying off your student loans in good times or bad.

What is a Student Loan?

At the basic level a student loan is usually an unsecured loan made by a bank or government back institution to you and depending on your age, your parents.

If you are going to attend College, you will more then likely need to borrow money to finance your education. In most cases your payments will not start until after you graduate, and hopefully have a job.

Should You Take Student Loans in Today's Economy?

If you are about to graduate High School, I suggest the better question would be what are your options in today's economy? Sadly even college grads can have a difficult time finding a job in down economical times, but you will never go wrong with a college degree in the long haul.

Our economy runs in cycles and when things start to pick up those that have degrees will be the first hired, while those without will need to wait longer for good employment.

When there are no jobs, the best place to be is in college furthering your education, preparing for a better tomorrow.

What if You Have Loans but No Job?

Because the economy is struggling, some resent College grads, might find themselves underemployed or even unemployed. This makes it difficult to make payments on student loans.

Low interest student loans are available through federal student loan sources as well as private sectors. Almost all private low interest student loans will require you to pass a credit check and this can be difficult if you are looking for private student loans options with bad or no credit. You will find that a many of the federal student loan programs do not require you to have collateral or even a credit check.

A lower interest rate means lower payments, a shortened repayment period and more money in your pocket. Interest will be charged beginning on the date of the first loan disbursement. Interest can be paid as it accrues or it will be added to the loan's principal balance upon repayment.

While it is sometimes possible to get a private loan with a very low interest rate, your best bet is with federal student loans. Federal education loans are available in either the Direct Loan or federally-guaranteed student loan programs. The Federal education loan programs offer lower interest rates and more flexible repayment plans than most consumer loans, making them an attractive way to finance your education.

Federal student financing (Stafford, Direct and Perkins loans) can be combined with outside and/or school awarded scholarships, like Pell grants (which do not have to be repaid), PLUS loans (made to students' parents), and other financing.

Start the process by filing the Free Application for Federal Student Aid (FAFSA), and submitting the application starting January 1 each year. Once your form is reviewed by the government, they will send you a letter called the student aid report. This report will tell you what programs you qualify for and how much money.

The school you listed on your FAFSA will also receive a copy of this report and will then structure a financial aid package, based on your qualified programs and send to you.

Don't pass up your opportunity for the lower rates offered by the government run programs, just because of paper work needed. The biggest benefit of filing a FAFSA could be that you also qualify for grants that you don't have to pay back.

The Federal student loan program is called the Direct Loan program. This is a low interest loan for students and parents to help pay for education beyond high school.

The loan is issued by the U.S. Department of Education directly, and there are no banks involved with these loans. Because you are borrowing directly from the federal government you will be able to administer everything to do with your loans using the Direct Loan Servicing Center. This makes it easier especially if you have multiple loans from different schools.

There are a number of types of loans that fall under the Direct Loan Program and there are some important differences that you should be aware of about how they charge interest.

The subsidized loan is for students that have a financial need determined by federal regulations. With this loan there are no interest charges while the student is in school at least half time. There is also no interest charge during the six month grace period following the completion or termination of classes, nor any deferment periods.

The unsubsidized loan is not based on financial need, and there will be interest charged as soon as the money is distributed. This means that even though you are not obligated to pay on the loan while in school, you will be charged interest during this period. You will also be charged interest during the six month grace period and any deferment periods.

The Plus loan is an unsubsidized loan for the parent of the student to help cover any educational costs not covered by any other financial assistance. Interest is charged during all periods for this type of loan.

There is also a Consolidation loan that combines any eligible federal student loans into one Direct Consolidation Loan. This has the advantages to lower your monthly payments by spreading you loan out over a longer term. While you will lower your monthly payment, you will pay more interest because of the longer term.

You can apply for any of the Direct Loans by filling out the Federal Student Aid application online. The information in the application is transmitted to the school you list in the applications and is used to determine all financial aid that might be available to the student.

There are no required payments due until the student falls below a half time status and there is also a six month grace period after graduation or termination in most cases. We will cover payment requirements and options in future articles.Whether you're looking for your first student loan, or your trying to figure out how to pay off the ones you have this article will have all the information you need to make the process easier.

Student loans and how they work can be confusing for most people. At the same time, it is very important for you to understand how student loans work in order to get the best deal and avoid common but costly mistakes.

After reading this article you will have a basic understanding about student loans. We will also talk about your options to paying off your student loans in good times or bad.

What is a Student Loan?

At the basic level a student loan is usually an unsecured loan made by a bank or government back institution to you and depending on your age, your parents.

If you are going to attend College, you will more then likely need to borrow money to finance your education. In most cases your payments will not start until after you graduate, and hopefully have a job.

Should You Take Student Loans in Today's Economy?

If you are about to graduate High School, I suggest the better question would be what are your options in today's economy? Sadly even college grads can have a difficult time finding a job in down economical times, but you will never go wrong with a college degree in the long haul.

Our economy runs in cycles and when things start to pick up those that have degrees will be the first hired, while those without will need to wait longer for good employment.

When there are no jobs, the best place to be is in college furthering your education, preparing for a better tomorrow.

What if You Have Loans but No Job?

Because the economy is struggling, some resent College grads, might find themselves underemployed or even unemployed. This makes it difficult to make payments on student loans.

Low interest student loans are available through federal student loan sources as well as private sectors. Almost all private low interest student loans will require you to pass a credit check and this can be difficult if you are looking for private student loans options with bad or no credit. You will find that a many of the federal student loan programs do not require you to have collateral or even a credit check.

A lower interest rate means lower payments, a shortened repayment period and more money in your pocket. Interest will be charged beginning on the date of the first loan disbursement. Interest can be paid as it accrues or it will be added to the loan's principal balance upon repayment.

While it is sometimes possible to get a private loan with a very low interest rate, your best bet is with federal student loans. Federal education loans are available in either the Direct Loan or federally-guaranteed student loan programs. The Federal education loan programs offer lower interest rates and more flexible repayment plans than most consumer loans, making them an attractive way to finance your education.

Federal student financing (Stafford, Direct and Perkins loans) can be combined with outside and/or school awarded scholarships, like Pell grants (which do not have to be repaid), PLUS loans (made to students' parents), and other financing.

Start the process by filing the Free Application for Federal Student Aid (FAFSA), and submitting the application starting January 1 each year. Once your form is reviewed by the government, they will send you a letter called the student aid report. This report will tell you what programs you qualify for and how much money.

The school you listed on your FAFSA will also receive a copy of this report and will then structure a financial aid package, based on your qualified programs and send to you.

Don't pass up your opportunity for the lower rates offered by the government run programs, just because of paper work needed. The biggest benefit of filing a FAFSA could be that you also qualify for grants that you don't have to pay back.

The Federal student loan program is called the Direct Loan program. This is a low interest loan for students and parents to help pay for education beyond high school.

The loan is issued by the U.S. Department of Education directly, and there are no banks involved with these loans. Because you are borrowing directly from the federal government you will be able to administer everything to do with your loans using the Direct Loan Servicing Center. This makes it easier especially if you have multiple loans from different schools.

There are a number of types of loans that fall under the Direct Loan Program and there are some important differences that you should be aware of about how they charge interest.

The subsidized loan is for students that have a financial need determined by federal regulations. With this loan there are no interest charges while the student is in school at least half time. There is also no interest charge during the six month grace period following the completion or termination of classes, nor any deferment periods.

The unsubsidized loan is not based on financial need, and there will be interest charged as soon as the money is distributed. This means that even though you are not obligated to pay on the loan while in school, you will be charged interest during this period. You will also be charged interest during the six month grace period and any deferment periods.

The Plus loan is an unsubsidized loan for the parent of the student to help cover any educational costs not covered by any other financial assistance. Interest is charged during all periods for this type of loan.

There is also a Consolidation loan that combines any eligible federal student loans into one Direct Consolidation Loan. This has the advantages to lower your monthly payments by spreading you loan out over a longer term. While you will lower your monthly payment, you will pay more interest because of the longer term.

You can apply for any of the Direct Loans by filling out the Federal Student Aid application online. The information in the application is transmitted to the school you list in the applications and is used to determine all financial aid that might be available to the student.

There are no required payments due until the student falls below a half time status and there is also a six month grace period after graduation or termination in most cases. We will cover payment requirements and options in future articles.

Tuesday, December 1, 2009

Debt Management

Debt management: great service to get free from debts

Debt management: great service to get free from debts

Every attempt to consolidate the multiple debts of a debtor fails because the action is not set in a well planned manner. Debt is a serious issue and demands to be dissolving with rational policies, and considering the debt management program is one of such deliberate advice that concentrates to dispose the debts to zero. The earlier steps taken regard them past, and approach for the debt management program for a rewarding and effective resolution. The objectives and principles of debt management program are adopted after assumptions and speculations which can stabilize or aid to rebuild the badly affected financial score in a sparing manner. Tactically and subtly, the policies are fused and carried out in a managerial way to consolidate the single or multiple debts as they are stronghold enough. Being a debtor is not a wrong sign; in order to qualify all the varied financial needs, inadequacy of required finance compels a person to take monetary support in the form of loans. However taking debt is considered bad in the society. Debtors, gradually, go in fix of debt trap due to mismanagement of repayment planning. Considering the fact of the matter, the lending authority has come up with the generous provision of bad debt management. Under the plan, debt elimination process is worked out.

Debt management program can be subscribed in a straightforward procedure. The practice of advancing debt management program is traditional and online, but the later is given the preference as it provides instant results to the applicants. While applying for a debt management program furnish data in an elusive manner and accurately in order to avoid delay. The services of debt program management reinstate and assist to supervise the future debts along with realizing demands.

Some people do not know how to manage their money. Others turn a deaf years despite warning signs of poor money management. However, getting out of debt is a function of learning and consistently applying good money bad debt management practices.

First of all, individuals must truly acknowledge they need help managing their debts. Once they truly decide to do something about their debts, they need a plan. Subsequently, figure out exactly how much they have owed. Write down all on a piece of paper. If unable to understand, then it is better to take help of any financial expert available nearby.

In prospect of providing a good bad debt management service, there are many lenders available in the money market for this generous cause. However with the advent of the internet, availing bad debt management has become very simple and easy. Henceforth, debtors have to fill in simple application forms available right online. Thereafter, a lender works for the debtor.

The lender gives entire of the debts into a single entity name, and calculates the amount and interest rates thereupon. After matching your dues and the amount you have, the lender makes a single monthly repayment scheme considerably. In such a way that both the creditors and the lender may not have to bear up any financial burnt. Debtors find their elimination of their debts under the provision of bad debt management very easy and simple.

The results of this debt management program are creditable. In short, the explicit advice deducts the monthly burden which you are obligated to different lenders. Multiple debts will be cut down to a single and debtors will have to be answerable to a particular creditor adding to the shedding of mental stress. In the market, the service of debt management program is provided by finance lending institutions in an easy way and the eligibility criteria is to be a victim of debts. The debt management program is released or functioning under different names, debt management service, debt management advice, debt consolidation program, debt consolidation advice and such, so that debtors can easily consolidate the debts. With the sustenance of such program debtors can also spot a lender who allocates finance at marginal rate of interest.

Debt management program can be subscribed in a straightforward procedure. The practice of advancing debt management program is traditional and online, but the later is given the preference as it provides instant results to the applicants. While applying for a debt management program furnish data in an elusive manner and accurately in order to avoid delay. The services of debt program management reinstate and assist to supervise the future debts along with realizing demands.

Some people do not know how to manage their money. Others turn a deaf years despite warning signs of poor money management. However, getting out of debt is a function of learning and consistently applying good money bad debt management practices.

First of all, individuals must truly acknowledge they need help managing their debts. Once they truly decide to do something about their debts, they need a plan. Subsequently, figure out exactly how much they have owed. Write down all on a piece of paper. If unable to understand, then it is better to take help of any financial expert available nearby.

In prospect of providing a good bad debt management service, there are many lenders available in the money market for this generous cause. However with the advent of the internet, availing bad debt management has become very simple and easy. Henceforth, debtors have to fill in simple application forms available right online. Thereafter, a lender works for the debtor.

The lender gives entire of the debts into a single entity name, and calculates the amount and interest rates thereupon. After matching your dues and the amount you have, the lender makes a single monthly repayment scheme considerably. In such a way that both the creditors and the lender may not have to bear up any financial burnt. Debtors find their elimination of their debts under the provision of bad debt management very easy and simple.

The results of this debt management program are creditable. In short, the explicit advice deducts the monthly burden which you are obligated to different lenders. Multiple debts will be cut down to a single and debtors will have to be answerable to a particular creditor adding to the shedding of mental stress. In the market, the service of debt management program is provided by finance lending institutions in an easy way and the eligibility criteria is to be a victim of debts. The debt management program is released or functioning under different names, debt management service, debt management advice, debt consolidation program, debt consolidation advice and such, so that debtors can easily consolidate the debts. With the sustenance of such program debtors can also spot a lender who allocates finance at marginal rate of interest.

Loan Consolidation

Fast debt consolidation loans: remove all your debts fast

Missed repayments lead to accumulation of debts for the borrower which in turn can hamper the credit history of the borrower. It is very important to remove these debts to avoid financial problems in the future. The borrower can get rid of these debts easily with the help of fast debt consolidation loans.

Fast debt consolidation loans helps the borrower by uniting all his debts into one single amount and pays it off to remove the multiple debts completely. The borrower now just has to repay one loan which is the fast debt consolidation loans instead of multiple unpaid debts which are charged at a higher rate of interest. This reduces the monthly outbound amount of the borrower and makes repayment comfortable for him.

The fast debt consolidation loans are borrowed at a rate of interest lower than the unpaid debts. This also helps in saving money of the borrower as interest, in addition to reducing the hassles that are caused to the borrower by the debts. Fast debt consolidation loans are beneficial to the borrowers who have debts of more than two lenders, amounting to more than £5000.

The borrower can take up the fast debt consolidation loans in the secured form by pledging collateral or in the unsecured form without attaching any collateral. Through secured form, he will get an even lower rate of interest than unsecured form.

Fast debt consolidation loans are available to bad credit borrowers also. They can use it to remove the debts and thus finally improve their credit history. The rates of interest offered to them are slightly higher but can be lowered by proper researching for loan deals.

Online availability of the fast debt consolidation loans helps the borrowers in undertaking a proper comparison of the loan deals. This way they can obtain lower rates with greater benefits.

With fast debt consolidation loans, the borrowers can have a sigh of relief as their debts can be removed easily and they can prevent debt problems in the future.

Fast debt consolidation loans: remove all your debts fast

Missed repayments lead to accumulation of debts for the borrower which in turn can hamper the credit history of the borrower. It is very important to remove these debts to avoid financial problems in the future. The borrower can get rid of these debts easily with the help of fast debt consolidation loans.

Fast debt consolidation loans helps the borrower by uniting all his debts into one single amount and pays it off to remove the multiple debts completely. The borrower now just has to repay one loan which is the fast debt consolidation loans instead of multiple unpaid debts which are charged at a higher rate of interest. This reduces the monthly outbound amount of the borrower and makes repayment comfortable for him.

The fast debt consolidation loans are borrowed at a rate of interest lower than the unpaid debts. This also helps in saving money of the borrower as interest, in addition to reducing the hassles that are caused to the borrower by the debts. Fast debt consolidation loans are beneficial to the borrowers who have debts of more than two lenders, amounting to more than £5000.

The borrower can take up the fast debt consolidation loans in the secured form by pledging collateral or in the unsecured form without attaching any collateral. Through secured form, he will get an even lower rate of interest than unsecured form.

Fast debt consolidation loans are available to bad credit borrowers also. They can use it to remove the debts and thus finally improve their credit history. The rates of interest offered to them are slightly higher but can be lowered by proper researching for loan deals.

Online availability of the fast debt consolidation loans helps the borrowers in undertaking a proper comparison of the loan deals. This way they can obtain lower rates with greater benefits.

With fast debt consolidation loans, the borrowers can have a sigh of relief as their debts can be removed easily and they can prevent debt problems in the future.

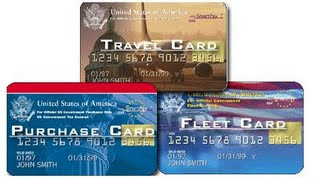

Credit Card Types

Low Interest Credit Cards: These are credit cards that offer low interest rates. These types of cards typically require that you have a good to great credit score/standing to get approved. Chase, Citi, and American Express are the leading providers of low interest credit cards today. These cards typically offer a 0% intro apr for at least 12 months.

Airline Travel Reward Credit Cards: These credit cards typically offer Airline rewards in the form of air miles. The leading provider of these cards is either American Express or Bank of America. These cards allow you to accumulate air miles every time you use the credit card. In return you can save on flights all over the world by simply using your credit card. This is the perfect card for the frequent flyer.

Cash Back Credit Cards: Cash back cards offer just that! Cash back on purchases. Most cards offer up to about 5% cash back on purchases. Some require that you make purchases at "selected locations" while others give you cash back on purchases anywhere. Chase has Cash Plus Reward Visa that is currently the leading cash back credit card on the market today.

Instant Approval Credit Cards: The instant approval credit cards require excellent credit! These cards will approve you instantly online with no waiting involved. American Express is the leader in online instant approval applications. In most cases you receive a decision in less than only 30 seconds.

Bad-Credit Credit Cards: Bad-credit credit cards are for those looking to rebuild or establish their credit. These are normally going to carry a yearly fee, and require that you make your payments very promptly. Orchard Bank & First Premier Bank are the leading providers of credit cards for bad credit.

Balance Transfer Credit Cards: If your looking to transfer the balance from one card to another then balance transfer credit cards are what you need! These typically offer 0% interest on any balances you transfer from other credit cards onto them.

Business Credit Cards: These cards are naturally for businesses. They have high limits and many perks that only those in the business world would really be interested in earning. Business cards normally require good credit standing due to the high credit limit you will receive. Again American Express is the leader in business credit card offers.

Gas Credit Cards: These cards offer what we all need! Gas rewards! You can earn up to 5% cash back on all gas purchases. Gas credit cards include the shell gas card from Citi and the Chase Cash Plus Reward Visa.

Hotel Reward Credit Cards: These cards allow you to accumulate hotel rewards or "points" you can then redeem the points for free nights at the hotels of your choice. We currently offer hotel cards for the Hilton hotels.

Student Credit Cards: Are you a student? need to establish some credit of your own? Well these are the perfect fit for you. Student cards by CitiBank and Chase offer rewards and credit building to all students.

Reward Credit Cards: Last but not least are the reward credit cards. These just offer airmiles, cash back, reward points, etc. These cards are for those looking to earn rewards for the charges made on your credit cards each day! Reward yourself with a reward credit card.

Low Interest Credit Cards: These are credit cards that offer low interest rates. These types of cards typically require that you have a good to great credit score/standing to get approved. Chase, Citi, and American Express are the leading providers of low interest credit cards today. These cards typically offer a 0% intro apr for at least 12 months.

Airline Travel Reward Credit Cards: These credit cards typically offer Airline rewards in the form of air miles. The leading provider of these cards is either American Express or Bank of America. These cards allow you to accumulate air miles every time you use the credit card. In return you can save on flights all over the world by simply using your credit card. This is the perfect card for the frequent flyer.

Cash Back Credit Cards: Cash back cards offer just that! Cash back on purchases. Most cards offer up to about 5% cash back on purchases. Some require that you make purchases at "selected locations" while others give you cash back on purchases anywhere. Chase has Cash Plus Reward Visa that is currently the leading cash back credit card on the market today.

Instant Approval Credit Cards: The instant approval credit cards require excellent credit! These cards will approve you instantly online with no waiting involved. American Express is the leader in online instant approval applications. In most cases you receive a decision in less than only 30 seconds.

Bad-Credit Credit Cards: Bad-credit credit cards are for those looking to rebuild or establish their credit. These are normally going to carry a yearly fee, and require that you make your payments very promptly. Orchard Bank & First Premier Bank are the leading providers of credit cards for bad credit.

Balance Transfer Credit Cards: If your looking to transfer the balance from one card to another then balance transfer credit cards are what you need! These typically offer 0% interest on any balances you transfer from other credit cards onto them.

Business Credit Cards: These cards are naturally for businesses. They have high limits and many perks that only those in the business world would really be interested in earning. Business cards normally require good credit standing due to the high credit limit you will receive. Again American Express is the leader in business credit card offers.

Gas Credit Cards: These cards offer what we all need! Gas rewards! You can earn up to 5% cash back on all gas purchases. Gas credit cards include the shell gas card from Citi and the Chase Cash Plus Reward Visa.

Hotel Reward Credit Cards: These cards allow you to accumulate hotel rewards or "points" you can then redeem the points for free nights at the hotels of your choice. We currently offer hotel cards for the Hilton hotels.

Student Credit Cards: Are you a student? need to establish some credit of your own? Well these are the perfect fit for you. Student cards by CitiBank and Chase offer rewards and credit building to all students.

Reward Credit Cards: Last but not least are the reward credit cards. These just offer airmiles, cash back, reward points, etc. These cards are for those looking to earn rewards for the charges made on your credit cards each day! Reward yourself with a reward credit card.

Cash for Structured Settlement

Cash for Structured Settlement.

In the market fall of 2008, you might have witnessed many families being rendered homeless and even you might have felt bitter touch of recession. These kinds of incidents are very common during an economic crisis. But how do you avoid such circumstances? You could cut down on your expenses to keep you floating. But what do you do if you lost your job and don't see any bright one’s ahead? Here's an instance of a family that I know of and how they were able to find the light deep in the jungle of darkness.

The husband of this family in consideration is a great friend of mine and he happened to narrate this incident to me once. He was working as a senior manager in a software firm. He had a loving wife, three kids and a very well paid job. To sum it up, he was living a great life. But when the markets came stumbling down, little did he know that this hit would affect him to the extent that it did. He lost his job. And due to his lavish lifestyle, it was not uncommon that he had a lot of loans on him. The loan lenders started to trouble him day and night asking him to either pay back the loan or vacate their home so that they can sell it off to settle the bill.

He saw no way out of this dangerous maze. Every direction he could take seemed to end up with a negative result. At this point, the family started going through all their financial assets to see if anything could lift them out of this hell hole. They found some sundry assets but they were not enough to pay off their debt and save their home. That's when the wife found the structured settlement she had received long back when she met with an accident. The structured settlement was scheduled for 30 years and it paid $900 a month. But this was insufficient either. So they decided to sell the structured settlement.

Consider yourself a plaintiff who has just won a compensation case. Now you are asked to choose the type of compensation you wish to receive i.e. a one time cash settlement or a structured settlement. The decision you make at this point of time must include a well thought over choice. In order to receive the right type of settlement, you need to analyze your over all situation and then decide which settlement will help you the most.

In most cases, a cash settlement is preferred, but it may not always be the right choice depending on your specific financial situation or future needs. In a case where you receive settlement for a case of injury where you had to be hospitalized, going for a lump sum settlement would seem better as you may wish to pay the mounting hospital bills without any burden. You may also take up any project that you had previously been holding back due to lack of sufficient funds. For example, getting a new house and setting it up the way you like, going on a vacation around the globe, etc. Cash settlements usually change your whole way of living, which might be a real pleasurable experience.

Lump sum settlements provide you with the total cash under your control. You may use it to invest in your business or take up a new career etc. The point is, cash sum settlements, and you are once and for all done with the defendant in the case and are totally free to make decisions as to where the money goes and how it circulates. This specific point will lead us to analyze the disadvantages of cash settlements due to the basic human tendency of making wrong decisions.

In case of lump sum settlements, you will be handed the total amount. Now it is your decision on the how to handle this sum of cash that will invariably decide the destiny of this amount. The general human behavior is to spend according to the income. Hence, you may start spending lavishly on account of the lump sum balance in your bank. If not planned properly, this amount that once seemed an inexhaustible sum will be merely enough to buy you, or if you are a nice person, just your date a movie ticket.

Another disadvantage of a lump sum settlement is that it tends to be much smaller then the structured payout. Usually people find that the lump sum settlement ideas not provide the relief for the pain and suffering. . A series of structured settlements will create ongoing compensation even for the individual’s lifetime that a lump sum amount does not provide. Hence one is required to consider all these factors while prompting for the type of settlement.

These are the very basic advantages and disadvantages of a lump sum settlement. To know the deeper and more technical aspects of lump sum settlements, talk to an expert in this field at Fair Field Funding. Fairfield Funding is a direct buyer of structured settlement annuities, will help get you cash for settlement.

If you were involved in an accident at work (workers compensation claim), been involved in an automobile accident, or a wrongful death case and won that lawsuit then you were awarded a settlement. If the amount was small it would have been awarded to you in a lump sum. If it was a rather large amount then it would be awarded to you in a Structured Settlement.

Another benefit of structured settlements is that they are specially designed to meet your needs over the period of time. In case of the death of payee the guaranteed portion of settlement is paid to beneficiary named in papers. One of the highlighted benefits of these regular payments is the excellent tax advantages that come with it. It is basically income exempted from taxes unlike the usual salary or other forms of income like royalty or dividends.

Selling your structured settlement payments will make you lose many tax benefits in the process. Selling this guaranteed income has only an advantage of large yet single payment. Ultimately, with structured settlements both parties are in a win-win situation; you become the recipient of a constant flow of income (possibly for life) and the responsible party for paying doesn't have to worry themselves with monthly or annual payments.

If your structured settlement is already in place, keep in mind that it was probably set up from the beginning in a way that is tax-advantaged for you. You may therefore have significant tax penalties if you decide to sell your payments for a lump sum. After receiving the necessary documents, from your attorney, most decisions are made within 48 business hours, depending on how soon they can talk with your attorney. When approved for funding, your funds are received within 24-48 business hours.

Even though the country was in chaos over the recession, a company decided to buy the family's structured settlement for a well bargained $50,000. This might have seemed as a stupid deal to outsiders but it was a splendid boon to the family. It just took them a couple of months to get their money wired to their account. They were finally successful in not only clearing off their loans but also were left with sufficient funds to help start their own business. The family currently run a computer trouble shooting business and is doing pretty well.

In the market fall of 2008, you might have witnessed many families being rendered homeless and even you might have felt bitter touch of recession. These kinds of incidents are very common during an economic crisis. But how do you avoid such circumstances? You could cut down on your expenses to keep you floating. But what do you do if you lost your job and don't see any bright one’s ahead? Here's an instance of a family that I know of and how they were able to find the light deep in the jungle of darkness.

The husband of this family in consideration is a great friend of mine and he happened to narrate this incident to me once. He was working as a senior manager in a software firm. He had a loving wife, three kids and a very well paid job. To sum it up, he was living a great life. But when the markets came stumbling down, little did he know that this hit would affect him to the extent that it did. He lost his job. And due to his lavish lifestyle, it was not uncommon that he had a lot of loans on him. The loan lenders started to trouble him day and night asking him to either pay back the loan or vacate their home so that they can sell it off to settle the bill.

He saw no way out of this dangerous maze. Every direction he could take seemed to end up with a negative result. At this point, the family started going through all their financial assets to see if anything could lift them out of this hell hole. They found some sundry assets but they were not enough to pay off their debt and save their home. That's when the wife found the structured settlement she had received long back when she met with an accident. The structured settlement was scheduled for 30 years and it paid $900 a month. But this was insufficient either. So they decided to sell the structured settlement.

Consider yourself a plaintiff who has just won a compensation case. Now you are asked to choose the type of compensation you wish to receive i.e. a one time cash settlement or a structured settlement. The decision you make at this point of time must include a well thought over choice. In order to receive the right type of settlement, you need to analyze your over all situation and then decide which settlement will help you the most.

In most cases, a cash settlement is preferred, but it may not always be the right choice depending on your specific financial situation or future needs. In a case where you receive settlement for a case of injury where you had to be hospitalized, going for a lump sum settlement would seem better as you may wish to pay the mounting hospital bills without any burden. You may also take up any project that you had previously been holding back due to lack of sufficient funds. For example, getting a new house and setting it up the way you like, going on a vacation around the globe, etc. Cash settlements usually change your whole way of living, which might be a real pleasurable experience.

Lump sum settlements provide you with the total cash under your control. You may use it to invest in your business or take up a new career etc. The point is, cash sum settlements, and you are once and for all done with the defendant in the case and are totally free to make decisions as to where the money goes and how it circulates. This specific point will lead us to analyze the disadvantages of cash settlements due to the basic human tendency of making wrong decisions.

In case of lump sum settlements, you will be handed the total amount. Now it is your decision on the how to handle this sum of cash that will invariably decide the destiny of this amount. The general human behavior is to spend according to the income. Hence, you may start spending lavishly on account of the lump sum balance in your bank. If not planned properly, this amount that once seemed an inexhaustible sum will be merely enough to buy you, or if you are a nice person, just your date a movie ticket.

Another disadvantage of a lump sum settlement is that it tends to be much smaller then the structured payout. Usually people find that the lump sum settlement ideas not provide the relief for the pain and suffering. . A series of structured settlements will create ongoing compensation even for the individual’s lifetime that a lump sum amount does not provide. Hence one is required to consider all these factors while prompting for the type of settlement.

These are the very basic advantages and disadvantages of a lump sum settlement. To know the deeper and more technical aspects of lump sum settlements, talk to an expert in this field at Fair Field Funding. Fairfield Funding is a direct buyer of structured settlement annuities, will help get you cash for settlement.

If you were involved in an accident at work (workers compensation claim), been involved in an automobile accident, or a wrongful death case and won that lawsuit then you were awarded a settlement. If the amount was small it would have been awarded to you in a lump sum. If it was a rather large amount then it would be awarded to you in a Structured Settlement.

Another benefit of structured settlements is that they are specially designed to meet your needs over the period of time. In case of the death of payee the guaranteed portion of settlement is paid to beneficiary named in papers. One of the highlighted benefits of these regular payments is the excellent tax advantages that come with it. It is basically income exempted from taxes unlike the usual salary or other forms of income like royalty or dividends.

Selling your structured settlement payments will make you lose many tax benefits in the process. Selling this guaranteed income has only an advantage of large yet single payment. Ultimately, with structured settlements both parties are in a win-win situation; you become the recipient of a constant flow of income (possibly for life) and the responsible party for paying doesn't have to worry themselves with monthly or annual payments.

If your structured settlement is already in place, keep in mind that it was probably set up from the beginning in a way that is tax-advantaged for you. You may therefore have significant tax penalties if you decide to sell your payments for a lump sum. After receiving the necessary documents, from your attorney, most decisions are made within 48 business hours, depending on how soon they can talk with your attorney. When approved for funding, your funds are received within 24-48 business hours.

Even though the country was in chaos over the recession, a company decided to buy the family's structured settlement for a well bargained $50,000. This might have seemed as a stupid deal to outsiders but it was a splendid boon to the family. It just took them a couple of months to get their money wired to their account. They were finally successful in not only clearing off their loans but also were left with sufficient funds to help start their own business. The family currently run a computer trouble shooting business and is doing pretty well.

Best Student Loan Lender

Low Cost Best Student Loan Lender

How to Select the Best Student Loan Lender

There are a variety of lenders offering low cost federal student loans as well as many options in private student loans.

Your student loan will possibly impact on your financial situation for several years, thus it is important for you to choose the best lender and a loan with the best terms that suits your situation and gives you some financial flexibility.

Many lenders offer various benefits to students, including reduced up-front fees or repayment incentives, which helps you save some money and have some financial flexibility.

As a student, it can be very difficult to decide which lender is good for you and which one lender should be avoided. By following simple tips, you will be able to select the best student loan lender.

Your selection of the lender should be based on the type of loan you want. There are many different loans that come from different loan programs. Therefore, you should have knowledge about these programs in order to choose one that best suits your needs and requirements. You can opt for federal student loans or private loans. The choice is yours. However, your selection process does not end here.

You also need to know what loan fees you will be paying when taking out the loan. Many lenders ask for origination fee to process the documents and you should find out what this fee is. If you have a good credit rating, it is quite possible that the lender will waive this fee.

Another aspect that you have to pay attention to is the interest rates. Federal loans have a set interest rate, so you do not have to worry about the rate changing. But this is not the case with private loans. Therefore, it is in your best interests to opt for a federal loan.

Find out if the lender has any incentives for borrowers. There are some lenders who reduce the interest rate once several on-time payments are made. Although this may seem inconsequential to you, remember it will make a big difference when you start repaying the loan amount after you graduate.

If you do not have a good credit or have not managed to establish credit, make sure that whoever signs as the co-borrower or co-signor has a good credit history. Usually this person is a family member or a close friend. This way you can be assured of getting a low interest rate and when you start repaying the loan, it will not seem so burdensome and inconvenient.

It is important for you to know that lenders may vary on different areas like interest rates, offers and terms and conditions. You will therefore to make a thorough research on some selected lenders and compare what they offer to make sure that you will get the loan that suits your needs and gives you the financial flexibility.

So Here Are The 7 Key Things You Will Need To Consider When Searching For A Lender For Your Student Loan?

1.The most useful forms of student loan programs are the Stafford and Plus federal loan programs, so you will need to establish if the prospect lender is part of the Stafford and Plus programs.

2.Most schools or colleges where you will be attending have a list of recommended loan lenders, and this is an important starting point for you. This list will give you a list of good lenders, from which you can start to do your research on who can offer you a loan that best suit your situation.

3.Find out from your prospect lender if they participate in electronic processes. Some lenders offer the option for electronic Fund Transfer in streamlining the student loan process. There are some who send loans via paper check to your schools, and it is necessary for you to know their procedures so that you will be able to choose the lender that will be convenient for you.

4.It is also recommended for you to know if student loan lender offers a special program that helps students avoid loan default.

5.It is important for you to find out if your prospect lender uses a service company. Borrowing money from a lender may be paying the money back to a service that is hired by the lender to take care of the management of the loan. You will need to know about all the parties involved in the student loan process.

6.Some lenders offer to sell loans to secondary markets, which can help you enjoy additional benefits like reduced interest rates. It is important for you to find out if the lender does offer an option to sell student loans.

7.Find out about the discounts, interest reductions and rebate programs which the prospective lender offers. Spend some time researching and checking on their websites to know more about their offers. Having a loan that has various favorable offers means that you will be able to make some savings.

It is important for you to have a student loan that is suited to you, and leaves you with time to focus on your studies. By following the hints stated about, you can easily get a loan that is stress-free and suited to your circumstances.

How to Select the Best Student Loan Lender

There are a variety of lenders offering low cost federal student loans as well as many options in private student loans.

Your student loan will possibly impact on your financial situation for several years, thus it is important for you to choose the best lender and a loan with the best terms that suits your situation and gives you some financial flexibility.

Many lenders offer various benefits to students, including reduced up-front fees or repayment incentives, which helps you save some money and have some financial flexibility.

As a student, it can be very difficult to decide which lender is good for you and which one lender should be avoided. By following simple tips, you will be able to select the best student loan lender.

Your selection of the lender should be based on the type of loan you want. There are many different loans that come from different loan programs. Therefore, you should have knowledge about these programs in order to choose one that best suits your needs and requirements. You can opt for federal student loans or private loans. The choice is yours. However, your selection process does not end here.

You also need to know what loan fees you will be paying when taking out the loan. Many lenders ask for origination fee to process the documents and you should find out what this fee is. If you have a good credit rating, it is quite possible that the lender will waive this fee.

Another aspect that you have to pay attention to is the interest rates. Federal loans have a set interest rate, so you do not have to worry about the rate changing. But this is not the case with private loans. Therefore, it is in your best interests to opt for a federal loan.

Find out if the lender has any incentives for borrowers. There are some lenders who reduce the interest rate once several on-time payments are made. Although this may seem inconsequential to you, remember it will make a big difference when you start repaying the loan amount after you graduate.

If you do not have a good credit or have not managed to establish credit, make sure that whoever signs as the co-borrower or co-signor has a good credit history. Usually this person is a family member or a close friend. This way you can be assured of getting a low interest rate and when you start repaying the loan, it will not seem so burdensome and inconvenient.

It is important for you to know that lenders may vary on different areas like interest rates, offers and terms and conditions. You will therefore to make a thorough research on some selected lenders and compare what they offer to make sure that you will get the loan that suits your needs and gives you the financial flexibility.

So Here Are The 7 Key Things You Will Need To Consider When Searching For A Lender For Your Student Loan?

1.The most useful forms of student loan programs are the Stafford and Plus federal loan programs, so you will need to establish if the prospect lender is part of the Stafford and Plus programs.

2.Most schools or colleges where you will be attending have a list of recommended loan lenders, and this is an important starting point for you. This list will give you a list of good lenders, from which you can start to do your research on who can offer you a loan that best suit your situation.

3.Find out from your prospect lender if they participate in electronic processes. Some lenders offer the option for electronic Fund Transfer in streamlining the student loan process. There are some who send loans via paper check to your schools, and it is necessary for you to know their procedures so that you will be able to choose the lender that will be convenient for you.

4.It is also recommended for you to know if student loan lender offers a special program that helps students avoid loan default.

5.It is important for you to find out if your prospect lender uses a service company. Borrowing money from a lender may be paying the money back to a service that is hired by the lender to take care of the management of the loan. You will need to know about all the parties involved in the student loan process.

6.Some lenders offer to sell loans to secondary markets, which can help you enjoy additional benefits like reduced interest rates. It is important for you to find out if the lender does offer an option to sell student loans.

7.Find out about the discounts, interest reductions and rebate programs which the prospective lender offers. Spend some time researching and checking on their websites to know more about their offers. Having a loan that has various favorable offers means that you will be able to make some savings.

It is important for you to have a student loan that is suited to you, and leaves you with time to focus on your studies. By following the hints stated about, you can easily get a loan that is stress-free and suited to your circumstances.

Bankruptcy and Student Loans

Bankruptcy and Student Loans.

Many people are under the impression that bankruptcy and student loans go together. When faced with outrageous prices for education it would seem that it would be an answer to many seeking relief. However, they do not mix and it is extremely difficult to have them discharged in a bankruptcy court.

Interestingly, in the 1970's it became common practice for someone to attend school and then file bankruptcy and student loans would disappear. It was a sure way to get a free education. Of course, as these cases grew, the government decided to limit the availability of this option. It became increasingly difficult to file for bankruptcy right after school. The common practice was now to wait at least seven years so the loan would be old. In order to file a person simply had to show that they had made their first payment seven years prior and that the loan was causing undue hardship. It was easy to prove the benefits of filing for bankruptcy.

In October 1998, the issue of bankruptcy and student loans again came to the forefront. The court ruled that such a case could not be filed and discharged unless three criteria were met. A person could not open a case unless they met this criterion. The first of these criteria is that you must prove to the court that you cannot keep up with your payment schedule. The second criterion is that you must prove to the court is that you are unable to pay in the future and that your financial situation is permanent. The third and final criterion is that you have made a good-faith effort to pay them back. If and only if you meet all of these criterions, may you open and file a bankruptcy and student loans case.

Even if you meet all of the requirements for opening a bankruptcy and student loans case, there is no guarantee that your loans will be discharged. It will depend on the judge that is hearing your case. Some judges will discharge some of the loans and leave you to pay part of them. Some judges will hear your case and will not discharge any of your loans. Once in awhile, a judge will take your particular case under advisement and discharge everything. This is extremely rare, but it is possible. It is not easy work to get a bankruptcy and student loans case discharged!

When you pursue your education, act responsibly and think before you apply for a student loan. Without foresight into your future, you could find yourself filing a bankruptcy and student loans case and damage the very future you have been working so hard to achieve.

When facing serious financial difficulties, most people resort to filing bankruptcy to eradicate their personal debts and start anew. Though it's clear that declaring bankruptcy is a viable option, discussing it further with your lawyer will determine whether it really is the best move to take. Some debts, such as those on student loans, can't be nullified by bankruptcy unless certain special conditions are met.

Other debts, such as child support obligations and federal taxes, also can't be resolved by bankruptcy. Likewise, drunken driving cases that resulted to criminal fees or judgments will still have to be attended to. Student loans fall into this category.

It's important to understand the logic behind student loans. Congress makes it difficult to eliminate student loans to encourage lending companies to give out such loans. This lets more individuals go to college and generate higher incomes as they reach working age.

Resorting to bankruptcy because of student loan difficulties isn't easy. You have to be familiar with "undue hardship" if you want to wipe out your loans. "Undue hardship" basically means you can't settle your debts, even when living at the lowest acceptable standard of living set by the government. When that sounds like your situation, then a sympathetic judge just might order your student loan debts wiped.

The law isn't very clear in such situations, but if you can satisfactorily prove that you've tried (and failed) to settle your debts in the past, and that your situation isn't likely to get better anytime soon, and then you stand a good chance of winning.

If bankruptcy doesn't take care of your student loan debts, you may want to resort to an administrative discharge. While the chances are slim, it's still worth a try. For instance, if you're disabled for life, then you'll likely qualify for an administrative discharge that eliminates your student loan debts. Joining the military or the Peace Corps are also good ways to wipe out your debts.

Student loans and Bankruptcy - why can't they be wiped out with a Chapter 7? Congress passed a law that made student loans payable no matter what your circumstances are, there is no statute of limitations on the debt which means you will owe this debt until you can pay it off. There have been some cases of proof of financial hardship where the court might have reduced the debt or deferred payment, but this is rare.

So what is financial hardship? Would mean that you would have a limited amount of money and a lot of mouths to feed and no money left over to pay this debt off over 10 years and sometimes stretching it over 25 years with consideration by the court of increased wages over the future years.

There are some cases of wiping out part of your debt by a chapter 7 and even deferring payment over a year or so. Usually this will depend on the state where you live and the court to decide what they can do with your student loan because of the new law passed by Congress.

Chapter 13 Bankruptcies do have the option to accept payments in the amount deemed by the trustee and an amount that you can afford, but when the chapter 13 is over you still owe the balance and the interest due on the student loan.

If you cosigned on a student loan you are also responsible to pay the loan back even if you the student cannot pay it and again it cannot go through bankruptcy and be discharged. Check with a Bankruptcy Attorney about the student loan and your bankruptcy plans so you can find the best solution for your circumstance.

Many people are under the impression that bankruptcy and student loans go together. When faced with outrageous prices for education it would seem that it would be an answer to many seeking relief. However, they do not mix and it is extremely difficult to have them discharged in a bankruptcy court.

Interestingly, in the 1970's it became common practice for someone to attend school and then file bankruptcy and student loans would disappear. It was a sure way to get a free education. Of course, as these cases grew, the government decided to limit the availability of this option. It became increasingly difficult to file for bankruptcy right after school. The common practice was now to wait at least seven years so the loan would be old. In order to file a person simply had to show that they had made their first payment seven years prior and that the loan was causing undue hardship. It was easy to prove the benefits of filing for bankruptcy.

In October 1998, the issue of bankruptcy and student loans again came to the forefront. The court ruled that such a case could not be filed and discharged unless three criteria were met. A person could not open a case unless they met this criterion. The first of these criteria is that you must prove to the court that you cannot keep up with your payment schedule. The second criterion is that you must prove to the court is that you are unable to pay in the future and that your financial situation is permanent. The third and final criterion is that you have made a good-faith effort to pay them back. If and only if you meet all of these criterions, may you open and file a bankruptcy and student loans case.

Even if you meet all of the requirements for opening a bankruptcy and student loans case, there is no guarantee that your loans will be discharged. It will depend on the judge that is hearing your case. Some judges will discharge some of the loans and leave you to pay part of them. Some judges will hear your case and will not discharge any of your loans. Once in awhile, a judge will take your particular case under advisement and discharge everything. This is extremely rare, but it is possible. It is not easy work to get a bankruptcy and student loans case discharged!

When you pursue your education, act responsibly and think before you apply for a student loan. Without foresight into your future, you could find yourself filing a bankruptcy and student loans case and damage the very future you have been working so hard to achieve.

When facing serious financial difficulties, most people resort to filing bankruptcy to eradicate their personal debts and start anew. Though it's clear that declaring bankruptcy is a viable option, discussing it further with your lawyer will determine whether it really is the best move to take. Some debts, such as those on student loans, can't be nullified by bankruptcy unless certain special conditions are met.

Other debts, such as child support obligations and federal taxes, also can't be resolved by bankruptcy. Likewise, drunken driving cases that resulted to criminal fees or judgments will still have to be attended to. Student loans fall into this category.

It's important to understand the logic behind student loans. Congress makes it difficult to eliminate student loans to encourage lending companies to give out such loans. This lets more individuals go to college and generate higher incomes as they reach working age.

Resorting to bankruptcy because of student loan difficulties isn't easy. You have to be familiar with "undue hardship" if you want to wipe out your loans. "Undue hardship" basically means you can't settle your debts, even when living at the lowest acceptable standard of living set by the government. When that sounds like your situation, then a sympathetic judge just might order your student loan debts wiped.

The law isn't very clear in such situations, but if you can satisfactorily prove that you've tried (and failed) to settle your debts in the past, and that your situation isn't likely to get better anytime soon, and then you stand a good chance of winning.

If bankruptcy doesn't take care of your student loan debts, you may want to resort to an administrative discharge. While the chances are slim, it's still worth a try. For instance, if you're disabled for life, then you'll likely qualify for an administrative discharge that eliminates your student loan debts. Joining the military or the Peace Corps are also good ways to wipe out your debts.

Student loans and Bankruptcy - why can't they be wiped out with a Chapter 7? Congress passed a law that made student loans payable no matter what your circumstances are, there is no statute of limitations on the debt which means you will owe this debt until you can pay it off. There have been some cases of proof of financial hardship where the court might have reduced the debt or deferred payment, but this is rare.

So what is financial hardship? Would mean that you would have a limited amount of money and a lot of mouths to feed and no money left over to pay this debt off over 10 years and sometimes stretching it over 25 years with consideration by the court of increased wages over the future years.

There are some cases of wiping out part of your debt by a chapter 7 and even deferring payment over a year or so. Usually this will depend on the state where you live and the court to decide what they can do with your student loan because of the new law passed by Congress.

Chapter 13 Bankruptcies do have the option to accept payments in the amount deemed by the trustee and an amount that you can afford, but when the chapter 13 is over you still owe the balance and the interest due on the student loan.

If you cosigned on a student loan you are also responsible to pay the loan back even if you the student cannot pay it and again it cannot go through bankruptcy and be discharged. Check with a Bankruptcy Attorney about the student loan and your bankruptcy plans so you can find the best solution for your circumstance.

Bankruptcy

Choosing a Right Bankruptcy Attorney

It takes a great deal of consideration and thought before anyone is able to make the decision to go through with filing bankruptcy. If you have taken all the time you need to make this decision, than it is time to move forward. There is nothing more important than making sure that the bankruptcy process goes smoothly and every done according to the bankruptcy laws. In order to do this you are advised to hire a bankruptcy lawyer. Only a qualified professional can make sure your bankruptcy case is smooth and successful.

What you may be wondering now is how you are expected to afford to hire a Bankruptcy Lawyer when you are clearly in financial distress. This is often decided between the court of bankruptcy and the lawyer you hire depending on the seriousness of your case. You will find the more you learn about bankruptcy the more you will begin to see that it is nothing like a simple call and debts are eliminated and you can start over. There are many steps which need to be completed and not every bankruptcy case works the same.

Many people assume once they reach the point of declaring bankruptcy, there is nothing anyone can do and it is nothing more than saying "I am bankrupt". However, there is a great deal more to the process and there is no better step you can take than hiring a bankruptcy lawyer to guide you through to the other side. Don't try to go through bankruptcy alone, you will find nothing but more stress, confusion and paperwork. It is a great deal of work so why not rely on a professional to help you cope?

The first part of a bankruptcy case you may not be aware of is choosing which chapter of bankruptcy to file. There are 6 different chapters but the most common ones filed are chapter 7 and chapter 13. There is no one better to decide which chapter your situation falls under than a bankruptcy lawyer. The process of bankruptcy from here can be more than overwhelming. You will be inundated with paperwork and documentation to prove your income, your debts, your spending and your banking information to state just an example. It is at this point in the bankruptcy stage people either panic and cancels the entire thing because they do not know what they are being asked to do and they do not understand the process or they hire a bankruptcy lawyer to clarify everything.

Once you have decided to hire a professional they will guide you through the next steps which almost always include meetings with your creditors. During this stage of the process creditors as well as the bankruptcy court will try to organize a payment schedule to pay off your debts instead of liquidating your assets; if this can be avoided. Having a bankruptcy lawyer at your side during these meetings can really take a load of your mind and help you understand what is happening and what is best for your situation.

One of the biggest challenges of the average consumer today is how to budget his money wisely. Because of the rising costs of many commodities as well as other financial obligations, it isn't a surprise that millions of Americans are facing a crisis. People fall into huge amounts of debt, businesses fail, and payables remain unpaid. When worse comes to worst, there may be no other way but to file for bankruptcy. If you find yourself in such a situation, then it is high time to get the help of bankruptcy lawyers.

Bankruptcy lawyers may also be considered under the category of family lawyers, since they help settle family-related matters that involve the use of money and properties. Depending on your current financial status, a bankruptcy lawyer can determine your best ways of settling with the parties you are indebted to, or how you can pay off your debts. Take note that not all dire financial situations call for the filing of bankruptcy. Bankruptcy lawyers make it possible for you to assess your current standing, and assist you in getting back on track to a better financial status.

When a client files for bankruptcy, the lawyer represents you in a meeting where all your creditors are involved. Such companies that may be represented are your mortgage firm, your credit card company, auto loan provider, and others. If a client does not have enough to pay such debts, bankruptcy lawyers will negotiate the best ways for all parties to be appeased. When the court has determined that the client in question is unable to pay for his debts, he will be declared as bankrupt. Under this condition, a client cannot apply for loans and other restrictions will be imposed. After a period of five years, bankruptcy may be lifted, and the client has options for rebuilding his credit.

The current American depression is hitting everyone hard. Many people were having trouble staying afloat before the depression capsized their finances. To end their debtor’s calls many are considering bankruptcy. Bankruptcy is not a path to take lightly. Choosing to file can follow you for years and you need to see a professional so that you are sure it’s the right step to make. One of the biggest decisions you can make for your future, when faced with bankruptcy, is which lawyer to see.

There are many attributes that make a good bankruptcy lawyer, but even more which will mean a bad one. By knowing what to look for you can find a lawyer who will help you. Many people who are considering bankruptcy look for lawyers who offer a free consultation. Make sure you find a lawyer who offers a free consultation as it means they have nothing to hide. If they ask for money upfront there is no way to know what their service is like before you pay. The lawyer will outline your options and suggest which ones they think are best for you.

Just like you, lawyers need to make money. Some lawyers only collect money once you file for Chapter 7 Bankruptcy. Do not allow a lawyer to rush you into a decision. Its you financial future not theirs. Even though you do not have a lot of extra money to spend you will save money by spending a little on a good lawyer. A good lawyer will be able to save you money and assets or help you find a better way of dealing with your credit issue. Spend money on a good lawyer, it pays off.

A lawyer who is not attentive to your questions does not have your best interests in mind. If you feel that your lawyer is not listening to and answering you questions you should find a new lawyer. Lawyers see a lot of client and they have likely deal with a case just like yours but that does not give them the right to provide you sub par service. Fortunately there are many lawyers who will give you their undivided attention, just make sure you find those that make you comfortable.

Just as you choose a lawyer you should look for a law firm. Busy law firms often take batch cases and assign paralegals to bankruptcy cases. A lawyer who is to busy to talk to you is a direct message that your case is not important to them. If you don't feel comfortable with a law firm after your free consultation you can always look elsewhere. It is also a good idea to do a little research on your own. Before showing up to a law firm, find a little out about the many paths of bankruptcy. Research the meanings of Chapter 7 and Chapter 13 or how to build credit afterwards. Above all make sure to think about your financial future whether that be choosing a lawyer or asking for a loan

It takes a great deal of consideration and thought before anyone is able to make the decision to go through with filing bankruptcy. If you have taken all the time you need to make this decision, than it is time to move forward. There is nothing more important than making sure that the bankruptcy process goes smoothly and every done according to the bankruptcy laws. In order to do this you are advised to hire a bankruptcy lawyer. Only a qualified professional can make sure your bankruptcy case is smooth and successful.

What you may be wondering now is how you are expected to afford to hire a Bankruptcy Lawyer when you are clearly in financial distress. This is often decided between the court of bankruptcy and the lawyer you hire depending on the seriousness of your case. You will find the more you learn about bankruptcy the more you will begin to see that it is nothing like a simple call and debts are eliminated and you can start over. There are many steps which need to be completed and not every bankruptcy case works the same.

Many people assume once they reach the point of declaring bankruptcy, there is nothing anyone can do and it is nothing more than saying "I am bankrupt". However, there is a great deal more to the process and there is no better step you can take than hiring a bankruptcy lawyer to guide you through to the other side. Don't try to go through bankruptcy alone, you will find nothing but more stress, confusion and paperwork. It is a great deal of work so why not rely on a professional to help you cope?

The first part of a bankruptcy case you may not be aware of is choosing which chapter of bankruptcy to file. There are 6 different chapters but the most common ones filed are chapter 7 and chapter 13. There is no one better to decide which chapter your situation falls under than a bankruptcy lawyer. The process of bankruptcy from here can be more than overwhelming. You will be inundated with paperwork and documentation to prove your income, your debts, your spending and your banking information to state just an example. It is at this point in the bankruptcy stage people either panic and cancels the entire thing because they do not know what they are being asked to do and they do not understand the process or they hire a bankruptcy lawyer to clarify everything.

Once you have decided to hire a professional they will guide you through the next steps which almost always include meetings with your creditors. During this stage of the process creditors as well as the bankruptcy court will try to organize a payment schedule to pay off your debts instead of liquidating your assets; if this can be avoided. Having a bankruptcy lawyer at your side during these meetings can really take a load of your mind and help you understand what is happening and what is best for your situation.

One of the biggest challenges of the average consumer today is how to budget his money wisely. Because of the rising costs of many commodities as well as other financial obligations, it isn't a surprise that millions of Americans are facing a crisis. People fall into huge amounts of debt, businesses fail, and payables remain unpaid. When worse comes to worst, there may be no other way but to file for bankruptcy. If you find yourself in such a situation, then it is high time to get the help of bankruptcy lawyers.

Bankruptcy lawyers may also be considered under the category of family lawyers, since they help settle family-related matters that involve the use of money and properties. Depending on your current financial status, a bankruptcy lawyer can determine your best ways of settling with the parties you are indebted to, or how you can pay off your debts. Take note that not all dire financial situations call for the filing of bankruptcy. Bankruptcy lawyers make it possible for you to assess your current standing, and assist you in getting back on track to a better financial status.

When a client files for bankruptcy, the lawyer represents you in a meeting where all your creditors are involved. Such companies that may be represented are your mortgage firm, your credit card company, auto loan provider, and others. If a client does not have enough to pay such debts, bankruptcy lawyers will negotiate the best ways for all parties to be appeased. When the court has determined that the client in question is unable to pay for his debts, he will be declared as bankrupt. Under this condition, a client cannot apply for loans and other restrictions will be imposed. After a period of five years, bankruptcy may be lifted, and the client has options for rebuilding his credit.